EMR April 2024

Dear Reader

RECENT DEVELOPMENTS

Most forecasts can be characterized as rather pessimistic, as far as short- and medium-term expectations are concerned. Therefore, they can be considered somewhat unpromising and relatively incoherent. In this EMR we will focus on the average performance of several equity indices to try to define a likely outlook.

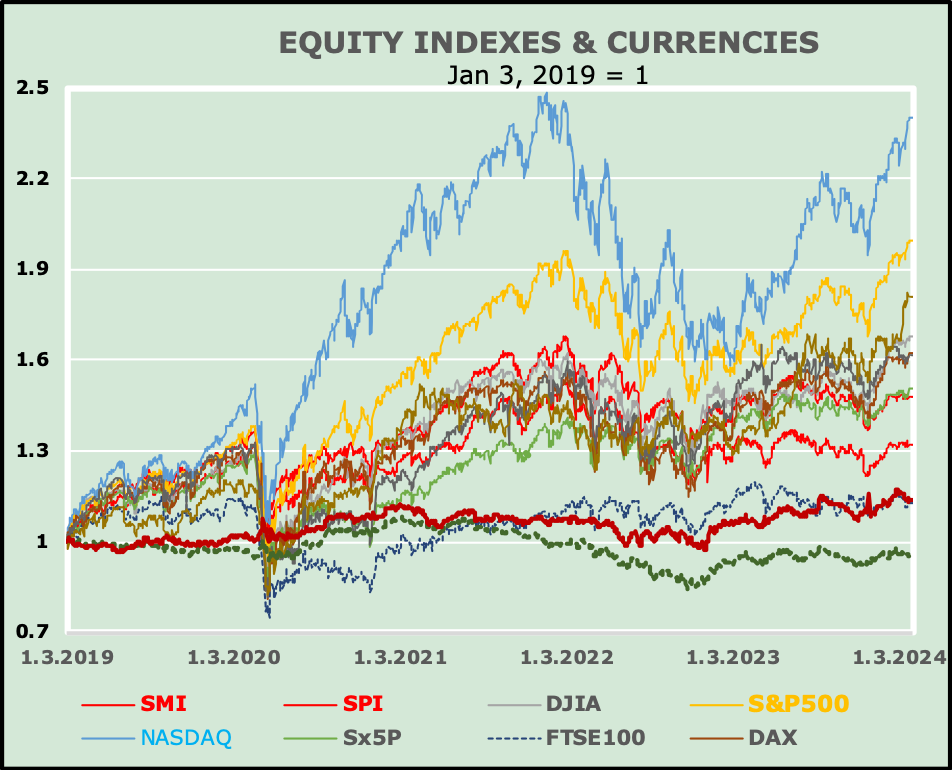

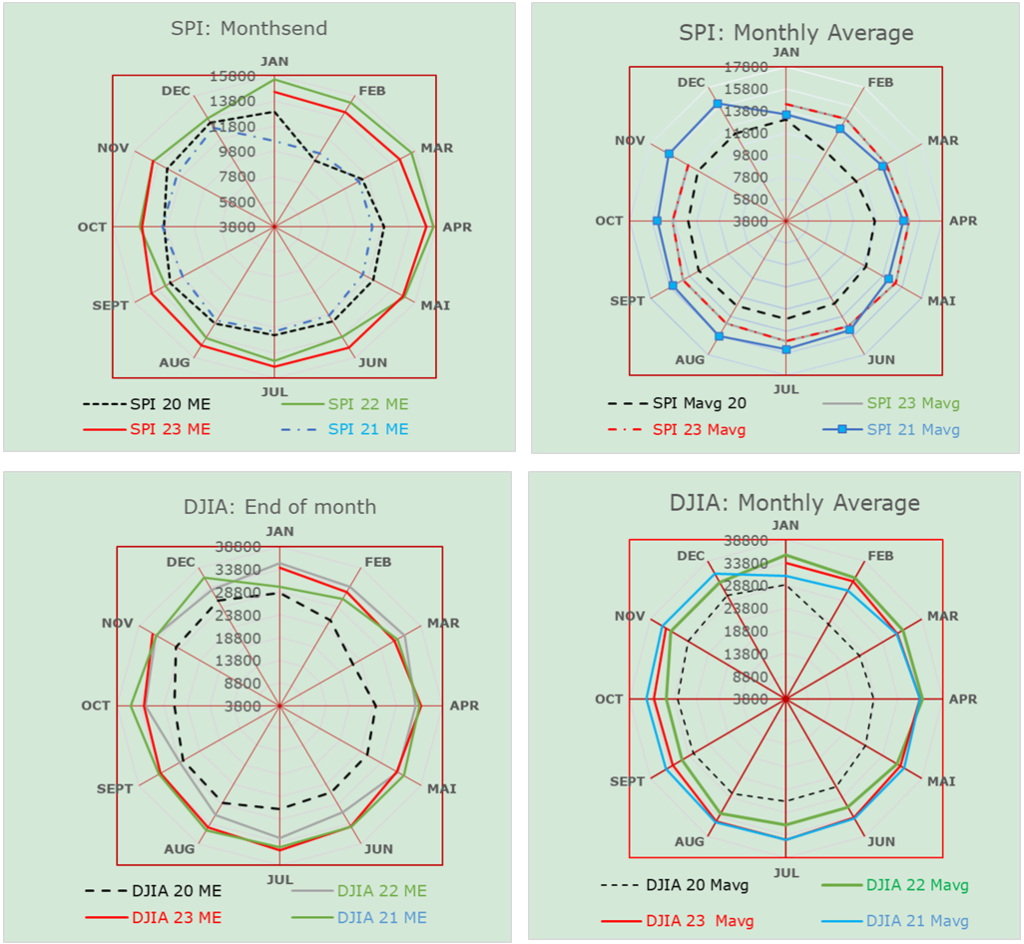

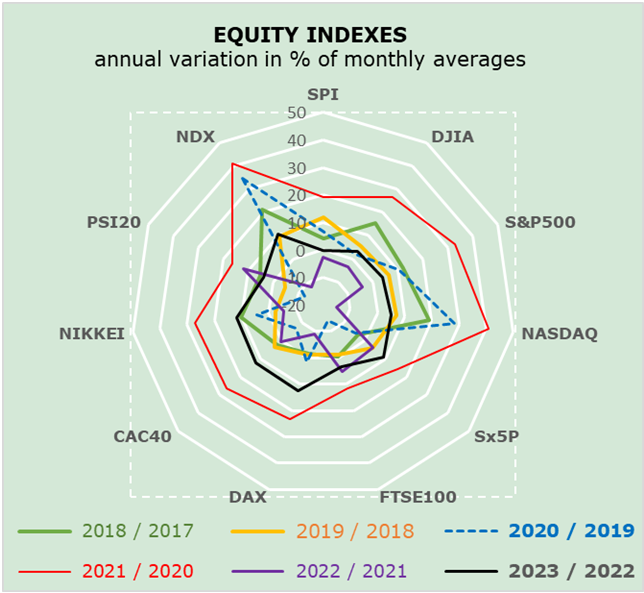

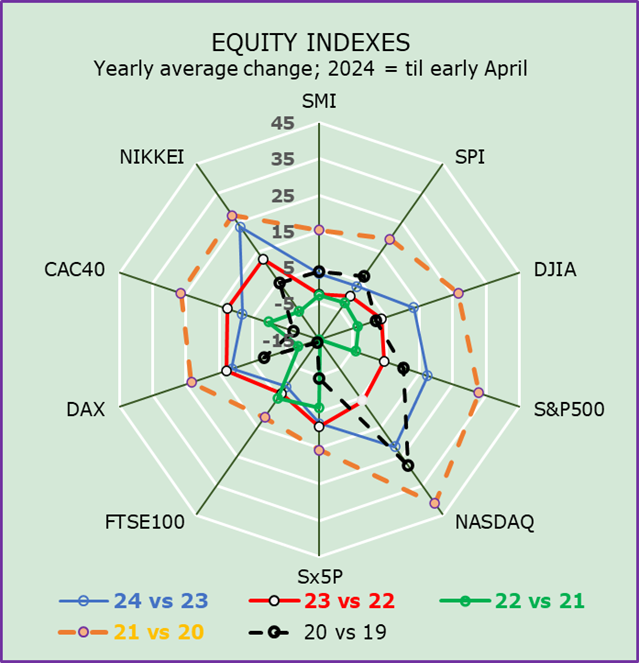

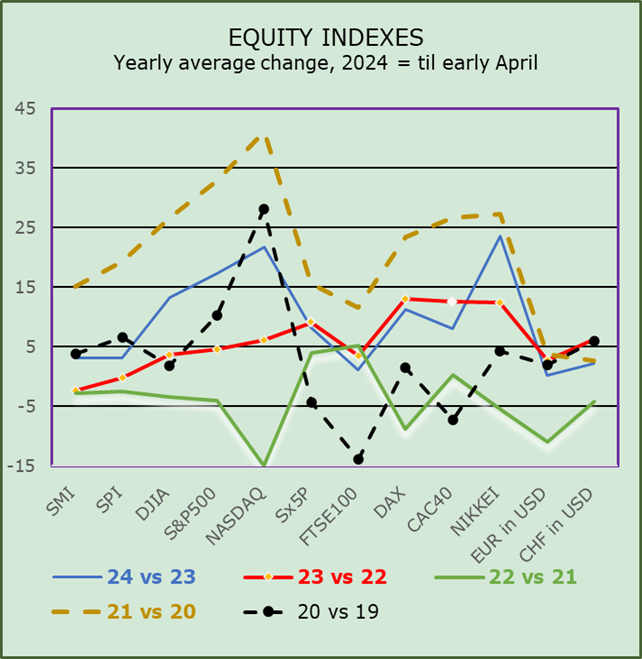

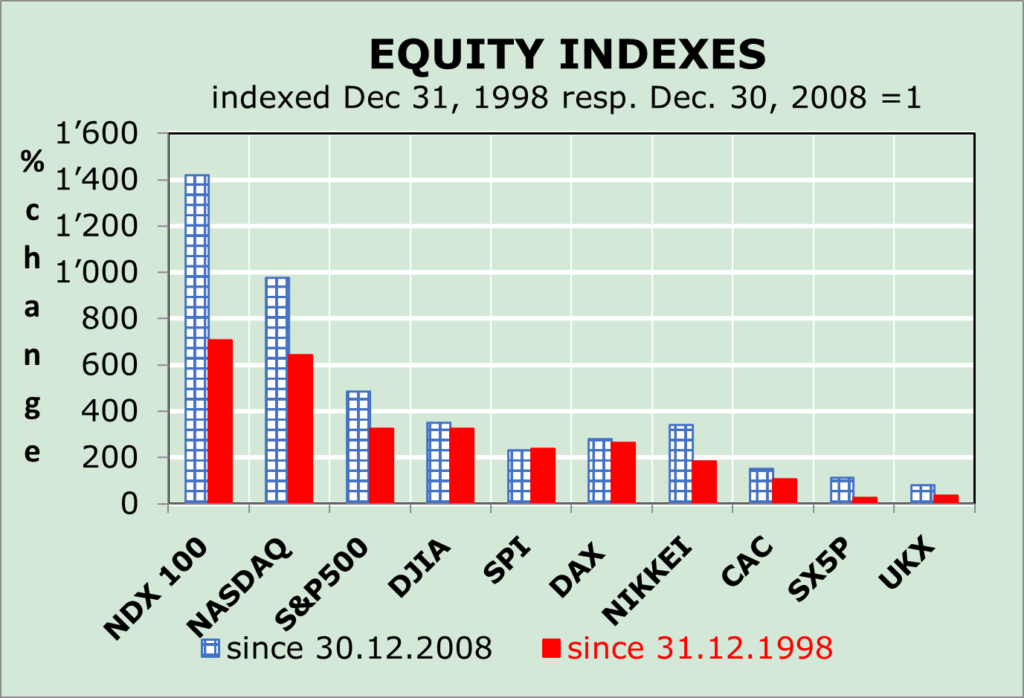

The following graphical representations of specific stock indices speak for themselves. In the first graph, we focus on the average annual change over the past four years in order to derive a promising result for the year 2024. The second graph uses the same data, and a traditional visualization.

Comparing the index increases shows that annual growth rates differ significantly from index to index. Does this suggest that the factors used to explain each index performances are not the same? In forecasting term this is the real question at this time, isn‘t it? Since the graph may pose particular interpretative difficulties, let us illustrate the same data in a more “traditional” way.

The charts show 2021 as the best performing year, while 2022 was the poorest performing one. From the traditional illustration it can clearly be inferred that the composition of the various indices speak for themselves throughout the period under review. The graphs, in line with known developments, indicate that the SARS-Covid 19 outbreak affected the European indices significantly more than the other indices. Recall that the first human case of Covid occurred in Wuhan, People’s Republic of China, in November 2019. The World Health Organization declared the outbreak of Covid-19 a health emergency of international significance on 30.01.2020 and a pandemic on 03.11.2020. Looking a little more closely at the recent, rather surprising past in order to assess the near future, we find the following determinant differences.

A first determinant, according to our personal assessment, relates to the technology content of each index. The reader might recall that in previous EMRs we have expressed our concerns about this, pointing out, for example, the outperformance of the NASDAQ index in the years 2020, 2021, and for the time being also in 2024. However, the current year’s performance is not really comparable due to the availability of short-term data. There is no doubt that 2022 was the worst performing year, according to the reported stock indexes, in conjunction with the Russian aggression on Ukraine. Since February 24, 2022, targeted disinformation and conspiracy narratives have accompanied the expansion of Russian aggression. Ongoing Russian aggression has and continues to have repercussions that are difficult to quantify, both economically and politically in general, with a devastating global impact in the short to medium term. We should not forget that Ukraine has been (and should remain) the breadbasket of Europe, while Russia is a major exporter of crude oil, especially in cooperation with suppliers in the Middle East.

ASSESSMENT

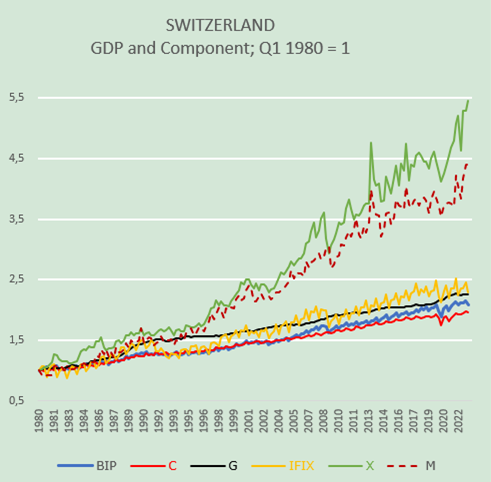

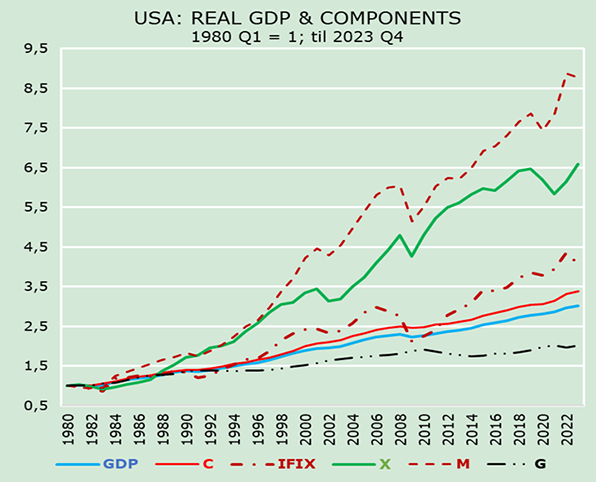

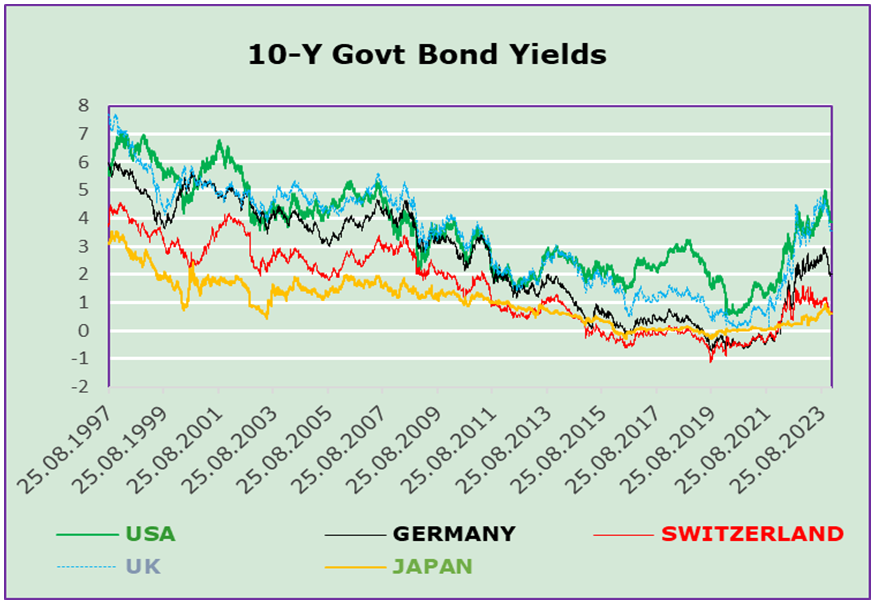

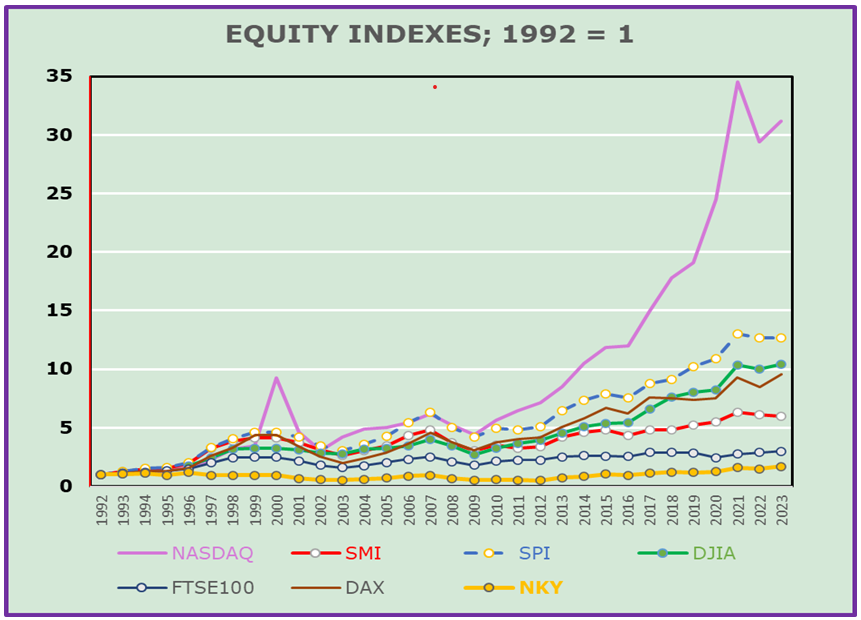

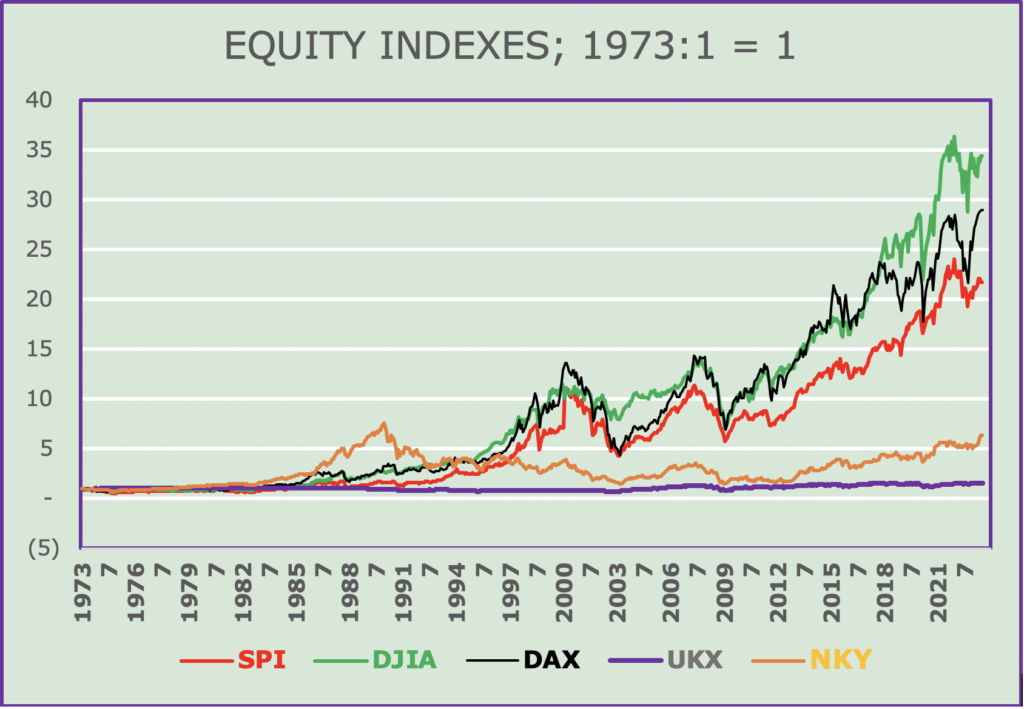

The following diagram suggest significant, differential impacts between one stock index and another. We believe that these differences are a clear indication that the performance of each index is not easily comparable, mainly because of the assessment of the impact of interest rate adjustments by Central Bank authorities. This is true for both the period since December 1998 and the period since December 30, 2008, and also for the most recent period from 2019 to the present.

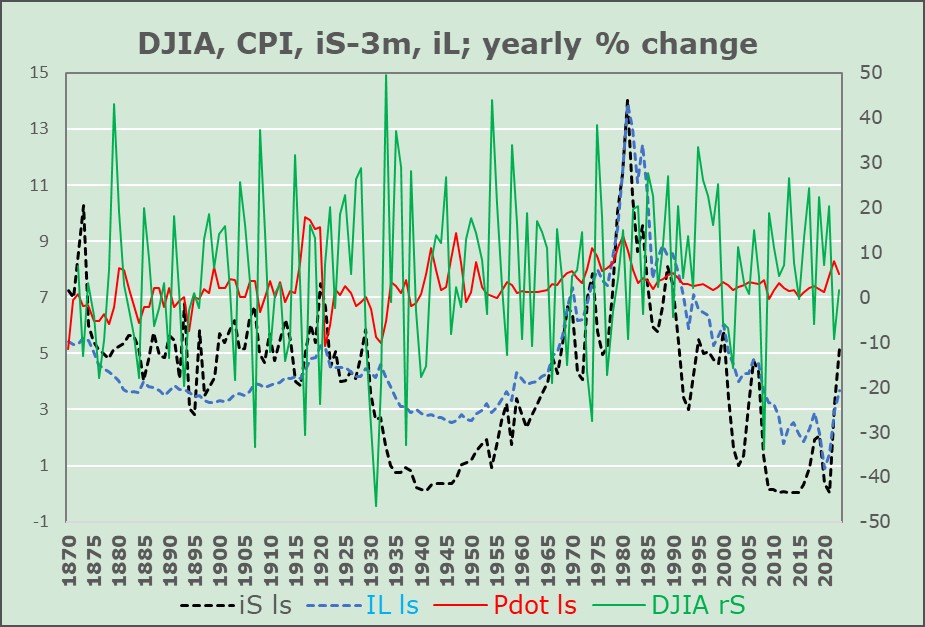

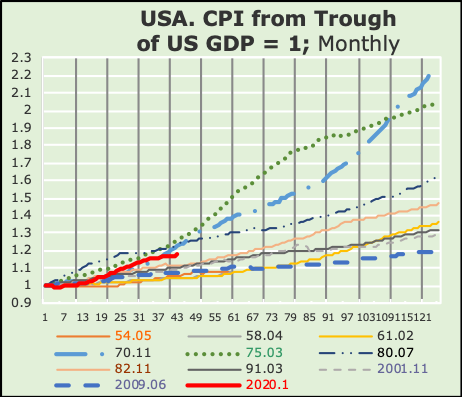

The charts allow us to characterize the focus on interest rates as the main determinant of market developments – mainly or even exclusively on the actions and reactions of monetary authorities – as rather questionable, if not misleading.

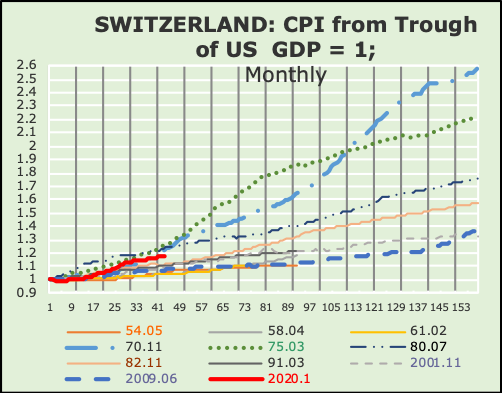

While searching for current clues on the whereabouts of interest rates, we came across an amazing infographic titled “The ECB and Its Watchers 24” focusing on the whereabouts of interest rates. The summary highlights the end of the inflationary spurt, the transmission of monetary policy and the banking system, and the relative impact of geopolitics. At the conference, ECB President Christine Lagarde emphasized that the ECB cannot commit to further rate cuts after a likely first move in June. … The latest move by the Swiss National Bank (SNB), on the other hand, is indeed astonishing. On March 21, 2024, it became the first central bank to announce a turnaround in interest rates, citing lower inflationary pressure and a stronger franc in real terms! At its March 2024 meeting the FED, on its part, kept rates unchanged, acknowledging that the economy is “strong”. It is worth recalling, that the FED has kept interest rates steady since July 2023.

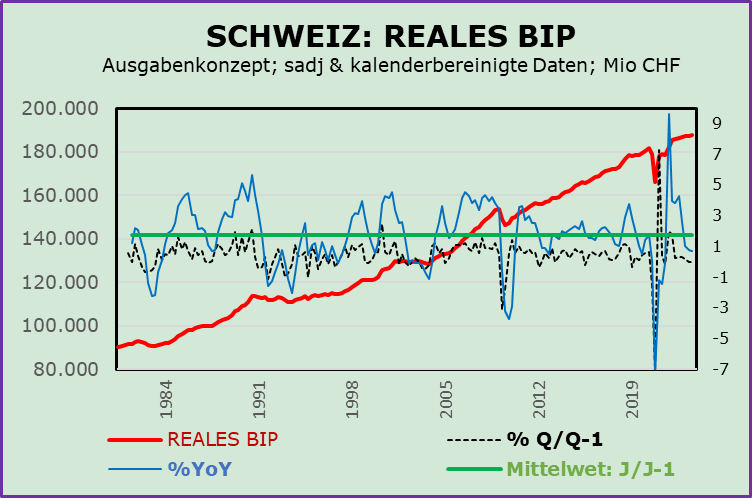

The tricky question at this point concerns the determinants of inflation and inflation expectations. Most commentators argue about the economic outlook and the possible reactions of central banks. From a Swiss perspective, the assessment could be very contradictory to the European and/or the US views.

Our assessment for Switzerland takes the Swiss franc into account as a key factor. The details relate to the outlook for import and export prices, both in the short and medium term. Rising crude oil prices, which as we know are quoted in USD, have a different impact on the “domestic” inflation rate via the appreciating CHF, than in countries with depreciating currency. The decisive factor for the CHF, in the current constellation, is not the actions of the SNB, but the international demand for CHF, which for many foreigners, is likely to represent a value of last resort.

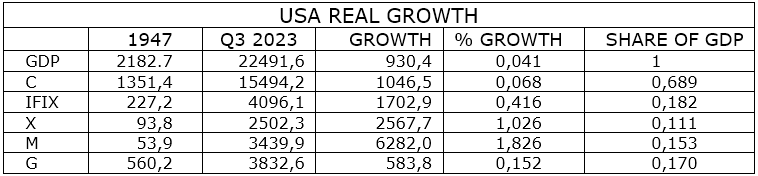

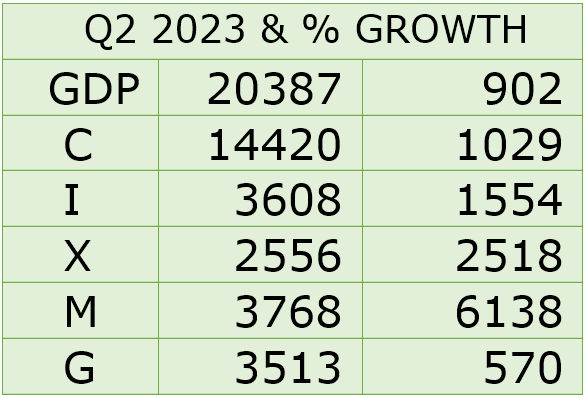

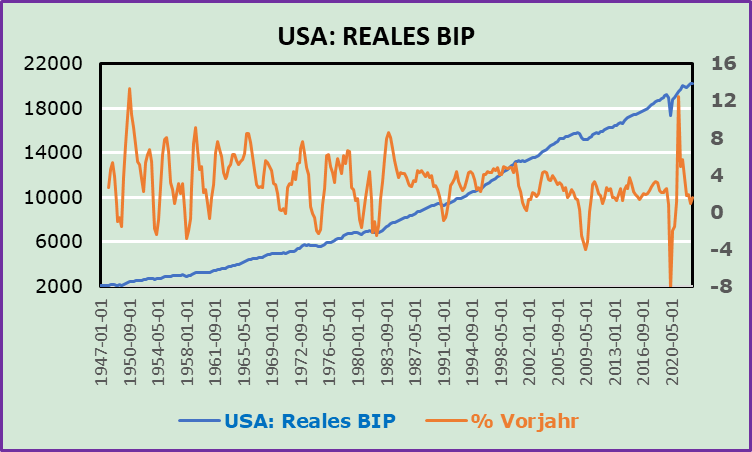

The USA and the European Union continue to focus on economic growth as a promising indicator for the whereabouts of the stock markets. At this stage, we see an important difference between the US and European economic outlooks. The growth outlook in the US is, in some ways, much more promising. The main determinant of US economic activity is the increasing “re-shoring” of production, particularly in technology-oriented sectors. One indication of this is the slowdown in imports of technology goods from China. If our different assessments are accurate, the Fed‘s assessment will prove to be correct, while the ECB‘s may not be as accurate.

EXPECTATIONS

The outlook remains difficult to assess. Both the Russian aggression against Ukraine and the lack of a prompt response from the most important international players make any economic assessment difficult and hardly quantifiably with sufficient certainty. Next you find our contextual assessment.

The primary determinant relates to the “end” of the Russian war against Ukraine. No politician seems to be able, willing and/or determined to confront Mr. Putin; not China, not the US, not the United Nations … We consider this to be the most difficult deterministic assessment at this crossing. We fear that international trade will lose out, also as a consequence of other conflicts around the world.

In this “absurd” environment, technology can still be seen as the most promising sector of the global economy, which should continue to drive engine of equity markets. We believe that an investment approach focusing primarily on the local market remain indeed promising. Expectations regarding economic growth can still not be assessed with sufficient certainty. We assume that volatility will remain substantial. In such an environment, inflation and interest rate expectations remain difficult to assess with a relatively high degree of certainty. As a result, a relatively high degree of “domestic” concentration must be factored in for a certain period of time.

Suggestions welcome.