EMR December 2021

Dear Reader

In this EMR, we take a look back at our forecasts and assumptions for 2021, and find that our preference for equities has been rewarded by an acceptable, differential rate of earnings growth. Taking the respective themes into account, we come to the following conclusions:

- The focus has been on Volatility, Virus and Vaccine and respective determinism on the asset allocation.

- Once again, we found that nothing is more deterministic than cyclical comparisons.

- We examined the repercussions on economic activity, inflation and interest rates.

- We clearly pointed out the various types of distortions, and

- We found that great upheavals create major opportunities.

ASSESSMENT 1: Yearly outperformance.

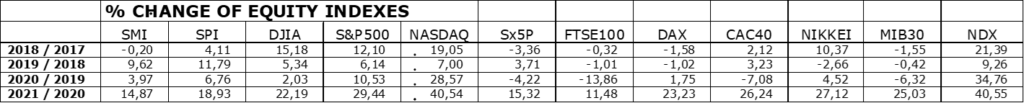

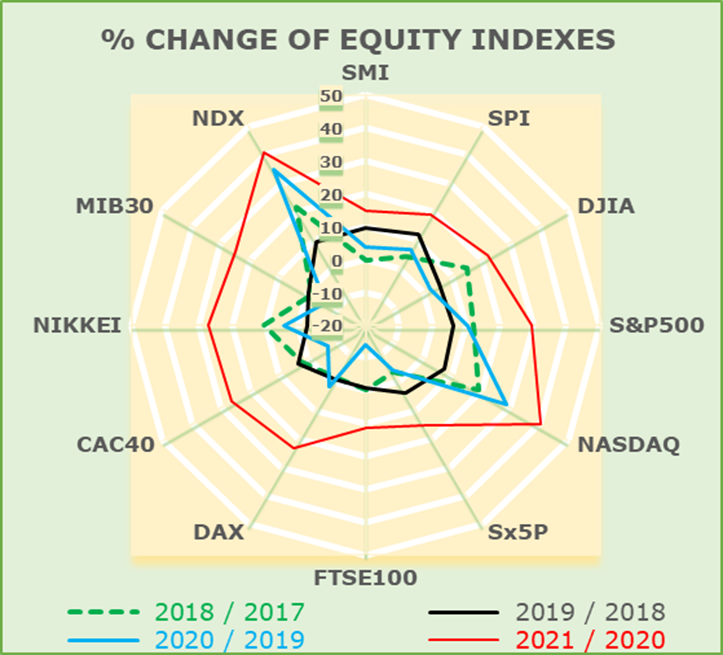

The following charts and table, based on the daily closing prices of selected stock indices, show the respective annual changes. It can clearly be seen that the stock indices performed better in 2021 than in the three previous years. The disparities can be summarized as follows:

One, there are sizeable differences between the indexes on a country-by-country basis, as well as between the technological content of the US indexes. The outperformance (as we repeatedly commented in various EMR`s) of the indexes heavy-weighted in technology is astonishing indeed. These developments underline the importance of sectorial selection.

Two, “simili modo”, we might argue that 10-year bond yields confirm our assessments to underweight this investment category and to take currency expectations resp. corrections seriously into consideration. Looking back to the singly 2021 EMR´s we find confirmation of our positive assessment of equities vs. bonds and money market investments. The returns differences, excluding taxes and other costs, clearly confirm the recent attractiveness of equities over bonds, as shown in the following table and charts. The longer-term analysis of 10-year bond yields (see chart below) is telling indeed.

What does the chart tell us? Let`s remember that pessimism was widespread in 2021. Yet, we did not adopt the widespread negative assessment. The average performance of 2021 over 2020 has been significantly better than in the three years before. In the following we summarize our reporting as in the various EMR´s of 2021.

ASSESSMENT 2: The three V`s: Volatility, Virus and Vaccine.

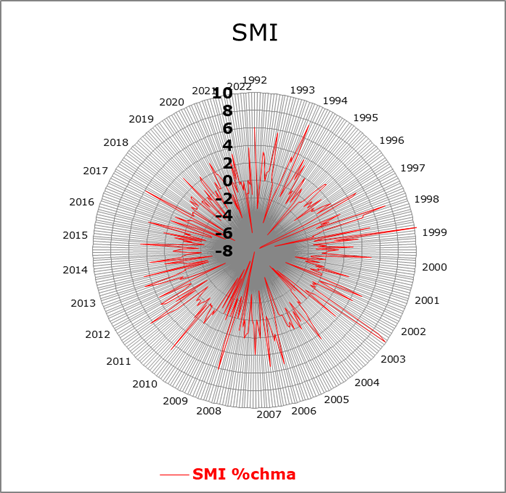

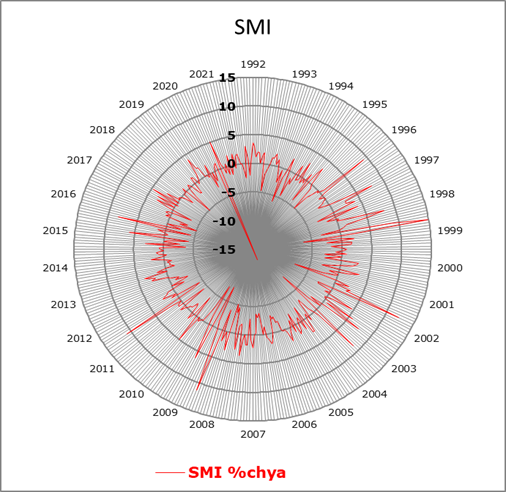

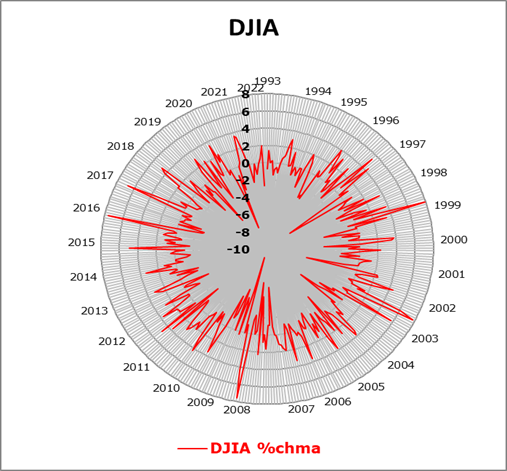

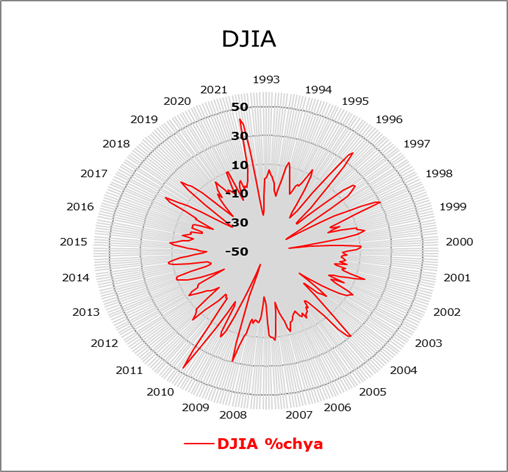

At no time we took daily Volatility, the Virus and/or the Vaccine as trend setting. In view of the outperformance of equities versus fixed-income securities and money market instruments, we allow ourselves to solely assess the fate of the Swiss and U.S. equity markets. The following charts show the respective average monthly rates of change, revealing quite different patterns. Surprisingly for some, we did not find confirmation of the well-known statement: “The trend is your friend”. The charts simply speak of the difficulties while defining the own expectations. We deem ourselves lucky, in focusing on the right data, as implicitly visible in the differential developments of the monthly vs. the yearly rates of change.

ASSESSMENT 3: Deterministic is the cyclical comparison.

Usually, the daily closing values (of the stock indices) are shown. From the respective growth rates, one can in most cases deduce in which market one should be over- or under-invested. The developments of the SMI and the DJIA shown in the charts above are, as already mentioned, quite difficult to interpret. Nevertheless, one can deduce where the short-term trend might be headed as compared to the longer-term trend. What is easier to estimate is the time it might take for the index to return to its “normal” growth path.

ASSESSMENT 4: repercussions on economic activity, inflation and interest rates.

We all know, that this is an exercise that can go either way, i.e., as a driver of the economy or as an impediment. Depending on the context, there are a variety of possible interpretations. In other words: forecasting the future is a difficult exercise. It requires the most appropriate selection of the appropriate factors shaping the future environment. Even the knowledge of previous comparative periods is not always suitable as desired. The environment may appear to be quite similar, although important determinants remain indeterminable. Currently, these difficulties are evident in expectations, depending on the hoped-for end of the Covid 19 pandemic. Moreover, it can be argued that technological innovation, can and should provide much needed clarity. At present, many analysts remain rather skeptical about these deterministic factors of the fate of consumer attitudes. They hardly simplify entrepreneurial decision making regarding the much-needed adjustment of production lines.

ASSESSMENT 5: distortions.

TYPES OF DISTORTIONS: In the July EMR we focused on the marginal rate of transformation in production (TTP) as well as on marginal rate of substitution in consumption (TTC) and also, on the foreign terms of trade (FTT). We argued that these three factors were, are and will continue to be deterministic for some time. The transformation of production lines influences and distorts consumption goods to be exchanged in the world markets. Hardly a day goes by without a comment on one of these factors. Just think of the influence of the various Covid regulations as determinant of production and consumption. Specific repercussions are then visible in due time in the quarterly statistics of economic activity (GDP and components). At this juncture any quantification looks rather problematic and uncertain. As an expedient many analysts focus on prices, i.e. inflation as a promising determinant of future developments.

ASSESSMENT 6: great upheavals create major opportunities.

As known, in the past great upheavals did create major opportunities. As an example, we point to the growth revival following the great recession of 2007 – 2009, for Switzerland and the USA. This, in our opinion, could definitely be something to look into in the 2022 EMR`s, given vivid hopes of a U-Turn in the Pandemic, which in due time could lead to a sizeable economic recovery on a worldwide scale. We are aware of the fact that currently it is rather difficult to be optimistic, given the attitude of Central Banks, particularly of the US Federal Reserve, to start reducing the overall liquidity in order to contain feared inflation pressures. Fears of inflation are, a function of “politically induced” strong consumer`s support, and also to prevent further increases in the rate of inflation. According to Chairman Powell, the FED is no longer primarily fixated on encouraging a further recovery in the long-running labor market, but primarily on getting the potential for inflation under control. The risks of price increases have also to do with the strong demand for goods and services and also with the hope of getting the supply bottlenecks under control.

MERRY CHRISTMAS and a HAPPY NEW YEAR 2022.

Comments are welcome.