EMR January 2024

Dear Reader

GENERAL CONDITIONS

Last year saw Russia’s much-publicized military misdeeds in Ukraine and the war in the Middle East, as well as international power struggles in the technology sector. In addition, a new difficulty emerged, namely the “closure” of the Suez Canal. Shipping companies have faced longer delivery times and thus increased costs for Asia-Europe trade through the Cape of Good Hope at the southern tip of Africa. These developments raise fears of an expectation of impending rising costs. Depending on the duration of the closures, this would mean an additional inflationary element that could not be addressed by interest rate adjustments by central banks.

It is well known that central banks are currently expected to further raise interest rates, in order to “lower” the inflation rate. The exception may be the USA. Although the just published inflation rate for December (3.4%) is higher than anticipated, it is to be expected that interest rates will be reduced further in the 2024 presidential election year. Officially independent of the Administration, the FED has been often shown to be politically aware in its timing. It is generally assumed that rising inflation rates, in due course, will lead to higher interest rates. We recognize this “Truism”, however, we wonder whether, in the given constellation, the reverse argument, i.e. higher required interest rates, would lead to a lower inflation rate? As already expressed in previous EMRs, we doubt it.

Readers may be wondering why we are so skeptical, i.e. that in the current circumstances higher interest rates from central banks can hardly influence the inflation rate, i.e. reduce it? It is well known that there are many reasons why prices rise/fall, as there are multiple causes of inflation. Price adjustments are, as we know, not simply the result of an expansion/restriction of the money supply or, simply put, the result of too much/too little money for a limited quantity of goods. It is well known that inflation has many causes. Preisanpassungen sind, wie wir alle wissen, nicht einfach das Ergebnis der Ausweitung/Einschränkung der Geldmenge oder einfach gesagt, das Resultat von zu viel/zu wenig Geld für eine begrenzte Menge an Waren. Die Inflation hat, wie wir alle wissen, viele Ursachen.

The best-known causes of inflation are defined as either demand (demand pull) or supply (cost pressure). At present, most analysts and central bankers use the demand pull as the determining forecasting tool, while we assume a shortage of supply. Even a superficial analysis of the factors determining inflation must assume that the shortage of crude oil, for example, due to Russia’s senseless attack on Ukraine and the war in the Middle East, including the short-lived closure of the Suez Canal, have driven up the price of one of the most important commodities (crude oil) and, as it looks now, will continue to play a role as a determining factor of uncertainty for some time to come. The rhetorical question we would like to ask here is: can further interest rate hikes by central banks put a stop to the restrictive supply policy? It seems to us that this is hardly possible, as supply restrictions can hardly be influenced by interest rate changes. As an indication, we would like to point to the price development during the OPEC period.

ASSUMPTIONS

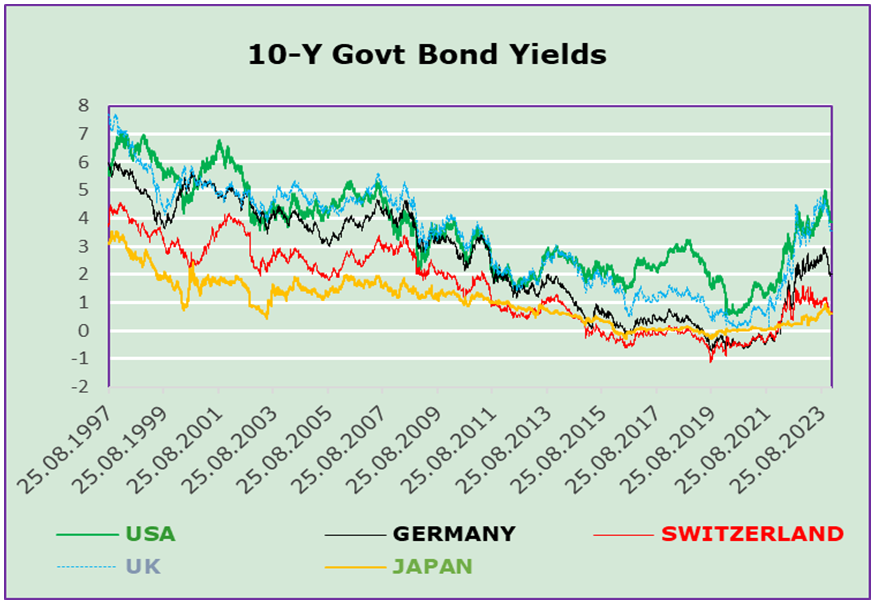

In the current environment, forecasts are characterized by various assumptions, which directly and/or indirectly affect investment policy. In this regard, it would be appropriate to contemplate the long-term behavior of equities and government bonds. Beginning with 10-year government bond yields, it can be assumed that the recent rise in interest rates is wearing off. However, the discrepancies should not be underestimated. It can be assumed that central banks will soon reduce short-term interest rates, which should result in lower government bonds in the short term. The latest levels (see chart) show divergent economic developments, for example between the United States (GT10) and the United Kingdom (GUKG10) compared to Japan (GJGB10) and Switzerland (GSWiSS10).

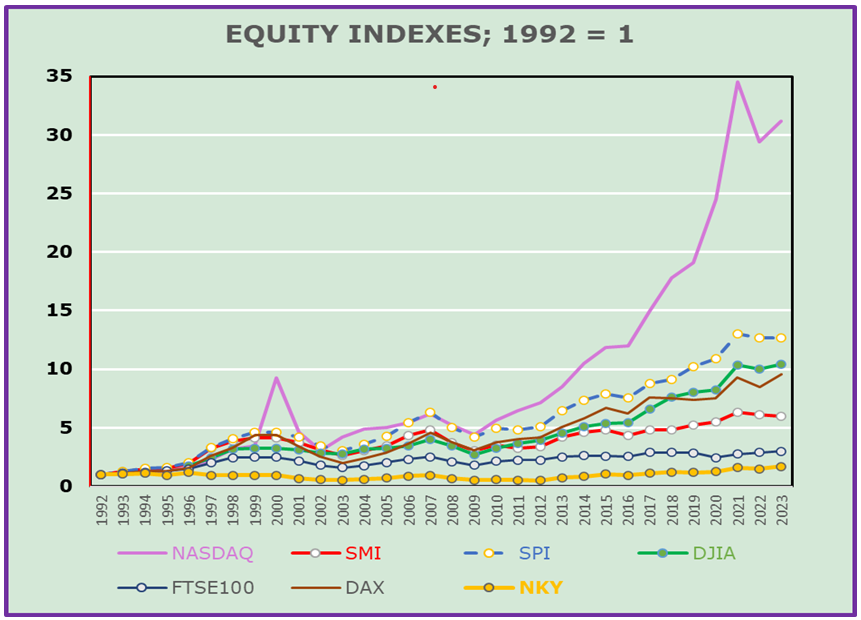

However, we think it is worth comparing the performance of various stock indexes e.g. since 1992 and, in this case, also the DJIA over the past four years, on a monthly average. The following can be deduced from the graph:

- The growth differential of the NASDAQ index against all others shown indexes is extremely high. It highlights sectoral developments, which should have been given serious consideration in asset allocation since 2010. One may wonder why so little attention has been paid to this determinate factor.

- Looking at the performance of the other listed indices, it is evident that there are large disparities here as well, for example between the Nikkei index and the SPI index. Overall, the difference in performance averages 10%.

- The question now arises: what will happen next? Our hypothesis follows in the next section.

CONSIDERATIONS

Every forecast is characterized by assumptions, especially in the current situation. The respective assumptions determine, directly and/or indirectly not merely the investment policy, but also the possibility of achieving successful returns in the presence of uncertainties.

Comparing the performance of the various stock indices since 1992, and/or the other listed indices, over the past four years, on a monthly basis, the following conclusions might be achieved:

- It remains inexplicable why the central banks’ focus on fighting inflation, by adjusting interest rates, accounts for such a marked difference between the performance of the DJIA (+10.4%) versus the Nasdaq (+31.2%) or the NIKKEI (+1.7%)?

- Assuming that the planned interest rate cuts by the central banks of the U.S., Eurozone and Switzerland are unlikely to have an equivalent and substantial impact on purchases and the number of transactions, what will be the respective impact on consumption and investment if war trends continue to have a significant impact on international trade?

CONCLUSIONS

We continue to believe that war developments in Ukraine and the Middle East will remain much more decisive than those mentioned above.

In other words, we continue to anticipate high volatility in the first two quarters of 2024, which will have to be dealt with mainly by adjusting sector and stock selection beyond equities.