EMR February 2026

Dear Reader

INTEREST RATES & EQUITY INDEXES?

Hardly a day goes by without a commentary – or even a request of a responsible politicians to further cut interest rates, in order to guide the whereabouts of inflation and equity indexes. As of recently, a further determinant is due to the repetitive requests of politicians, and in recent times, specifically, by the current U.S. president.

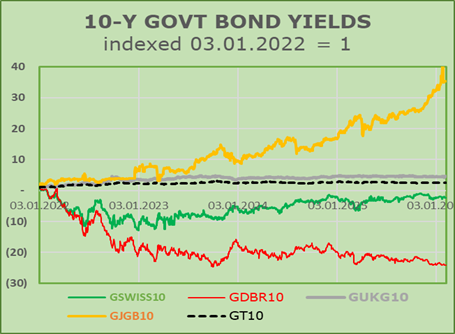

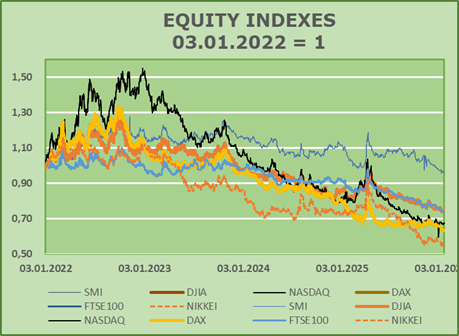

As is well known, we are not entirely convinced by this approach. Clear indications can be gleaned from the following charts, showing the indexed yields of 10-year government bonds and of selected major stock indices in their respective currencies, for the period since January 3, 2022 as shown in the two following charts.

SURPRISING INFORMATIONS FROM THE CHARTS

- The developments showed in the charts differ strikingly from one another, don’t they? Who, among us, has ever predicted such a strong increase of the Japanese yields, as compared to the opposite trend in German and, to some extent, Swiss yields?

- We take note that the data in the charts clearly point to assumptions other than those most commonly reported in the media. They clearly show that government bond yields strongly vary from country to country, thus requiring specific treatment. The dynamic of US yields is quite surprising, when compared e.g. to the trend of UK interest rates. The Japanese yields show a shocking increase, while the US counterpart points exactly in the opposite direction.

- At this crossroads, we believe that there are divergent actions and reactions in the market beyond inflation fears. In other words, we assume that there must be other determinants to which interest rates are responding, but which are not being reported in the press. Is there any contextual indication as to why this is the case? We believe that the activities of consumers and investors play an important role as an argument for anti-inflationary policy.

- The data on stock indices, on the other hand, tend to develop in a rather similar way, at least in terms of trends. The scrutiny of the performances speak another language, don’t the they?

- There must be other factors than monetary policy, i.e. interest rate measures, determining the whereabouts of the equity markets. Recalling the rather complex landscape since the beginning of 2023 we began to take into account the rising authoritarianism, and consequent geopolitical instability.

ASSUMPTIONS FOR THE INVESTMENT STRATEGY

The overall assessment is not easy to define with a high degree of certainty, and this particularly due to the following reasons:

- Rather weak political leadership in the Western nations.

- Rather disturbing political whereabouts and respective economic growth repercussions, which in turn call for higher exposures towards the home market, taking account pf the specific currency outlook.

- As Swiss investors, we continue to be overexposed to our home currency and equity market, a rather contained exposure to the European currency and equity markets and a slightly under-exposure to US equity investments as well as the USD.

- One feature that does not receive sufficient attention concerns the fiscal policies of the US president. As is well known, he likes to announce fiscal policy measures that sometimes go beyond the rules of supply and demand. Unfortunately, at this juncture, we are not in able to assess how decisive these unilateral measures are, and will be, for consumer spending, not only in the United States but also for countries exporting to the United States. The crucial question is: when will Mr. Trump realize that his policy is wrong and react accordingly?

SHORT-TERM EXPECTATIONS

As the primary determinant of the short-to-medium-term outllook we view the Trumps tariffs, as they undoubtedly represent a tax increase primarily in the context of consumer spending. Let us recall that recently consumer spending has been the engine of economic activity, i.e. the major propellent of GDP growth – not solely for the United States!

The Trump`s tariff increases are viewed as having a similar impact as a tax increase promotor. Contextually, we ought to keep in mind that the trade policy of President Trump represents an important, i.e. deterministic reduction of the supply of goods and services, with an expected negative impact on inflation.

As implicitly shown in the above charts, we view the historic comparison as indeed astonishing. Coherently, we deduce that the Trump’s abstruse taxation policy might continue to be a most significant determinant for economic activity, and at the same time be highly deterministic for the whereabouts of inflation, not only for the USA. We expect significant repercussions on a worldwide scale.

Consequently, we expect, or worse, we fear a rather deterministic indication pointing towards a reduction of economic activity driven particularly by consumer and investment spending, on a worldwide scale.

SUMMA SUMMARUM

The next few quarters speak for lower economic activity, concerning primarily the United States, and in due time also the world markets. From an investment perspective these trend-expectations, will undoubtedly matter. They speak, if we understand the whereabouts correctly for a significant HOME BIAS concerning both equities as well as currencies.

The most promising approach remains DIVERSIFICATION, which to us, seems to be, at this juncture, the only “Free Lunch” promising motor, on a local, as well as on the international scale.