EMR January 2026

Dear reader

CURRENT ENVIRONMENT

Assessing the current context is a complex exercise, as there are differences between determining factors, such as:

- Will Russia’s war against Ukraine end soon?

- Will economic growth prospects be the driving force, or will politics continue to play a leading role?

- Will the focus be set primarily on the monetary actions and reactions by the Central Banks?

- Or will traditional economic thinking be the “new pioneer”?

Fact is that we are constantly being told that interest rate developments are crucial to curbing a feared rise in inflation. Based on available data, we wonder, which of the above-mentioned assumptions will really be the valid and deterministic argument.

OPERATIVE ASSUMPTIONS

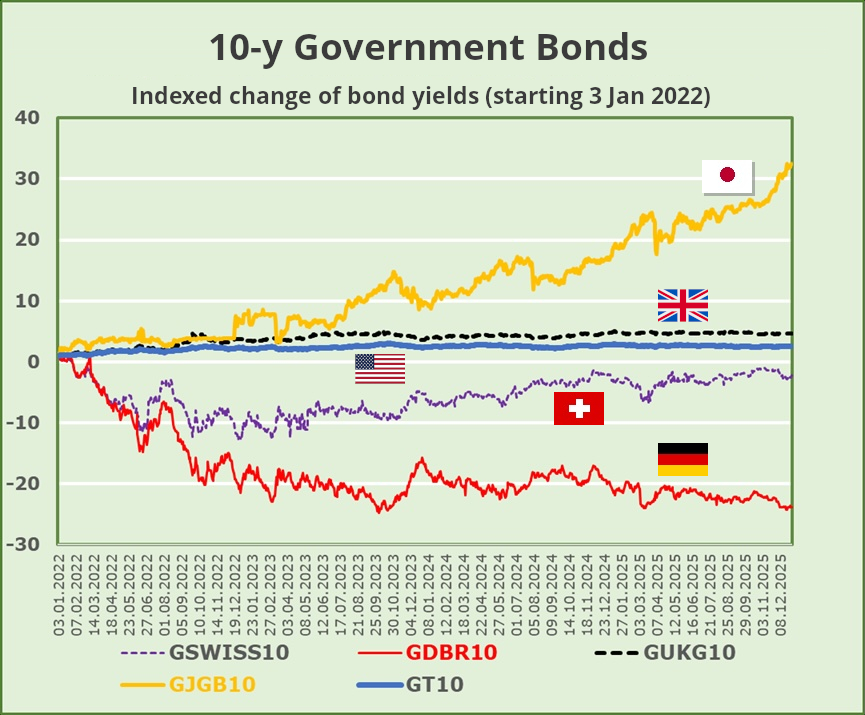

In order to be set in the position to assess the respective impacts of the above asked questions, we kindly ask the reader to examine the data, as implicit contained in the following chart of 10-year Government Bond Yields for Switzerland, Germany, UK, Japan and the USA. To better understand what the recent developments have been, we have indexed the respective rates on November 3, 2022 to 1.

With regard to the impacts of monetary policy management as a promising investment guide, we believe that the current interpretation cannot be considered as a consistent and promising policy indicator in the forecasting exercise. Contextually, we ask ourselves, why does a large majority of forecasters continue to focus on interest rate management to solve the current impasse.

The chart shows significant and deterministic differences between the reported 10-year government bond yields. The real question is: what does the chart actually reveal? Does it represent something different from what is regularly reported in the media? We believe that the chart highlights the risk that could arise from interpreting the impact of interest rate changes, as is currently the case, based on changes in 10-year government bond yields as a guide for the near future. Nevertheless, we invite the reader to examine the divergent paths shown, in order to better assess their growth trajectories and coherent impacts. In doing so, we found the following:

- The development of Japanese 10-year yields is undoubtedly astonishing when compared to the opposite trend in German yields. We wonder what consequences this divergence might have for investments in Japan compared to Germany?

- Astonishingly stable, over the shown period, have been the performances of Swiss and US yields. Do the respective developments indicate a corresponding response to a different environment?

With regard to the effects of monetary policy management as a promising investment guide, we believe that the current interpretation cannot be considered as a consistent and promising policy indicator in the current forecasting exercise. Contextually, we ask ourselves, why does a large majority of forecaster continue to focus on interest rate management to solve the current impasse?

OUTLOOK

Given the political, economic and social environment pinpointed in the above shown chart, the outlook for 2026, looks like a “very complicated and rather difficult task,” does it not? After a thorough examination of the recent developments of 10-year government bond yields we ask ourselves the question: Will inflation really be the main enemy of policymakers and/or investors?

In the event that the monetary authorities remain focused on fighting inflation through interest rate management, the outlook for investment returns remains rather subdued.

Why, one may ask?

In times of war, the continuing Russian invasion of Ukraine, and similarly disturbing developments in the Middle East, one might wonder how changes in interest rates might reduce the price of crude oil, especially in Europe? We should not forget that two of Europe’s largest economies (France and Germany) are going through a very tangled political situation, namely a serious lack of economic, social and political leadership. We think this context is quite problematic, if not dangerous.

However, if investors remain focused on sectors such as technology, as has been and should continue to be the case in the US, the outlook might significantly “brighten”. Certainly, at this crossroads we cannot predict what the new US administration will do, as the possibility of an America First policy is at the forefront.

SUMMING UP

Despite all the forecasting difficulties in timing, as Swiss franc investors, we continue to prefer our home market, primarily for efficiency reasons. We assume that the CHF will continue to be in high demand. As deducible from the above-mentioned General Conditions a highly deterministic factor is and will remain the war against Ukraine, particularly for security reasons, given its devastating, destructive importance of the availability of raw materials such as gas and crude oil.

Contextually, international diversification speaks, in line with the technological developments, once again for investment in the USA, despite the feared weakness of the USD vs. our own currency. As far as the EUR exposure is concerned, we are somewhat concerned about the political uncertainties in France and Germany.

While many analysts eagerly await monetary measures and reactions from central banks, we fear unprecedented actions and reactions from the US president, whose recent tax reform has had – and will likely continue to have – a rather negative impact on economic activity.

What we should keep in mind is the implicit lesson from recent interest rate trends – as shown in the chart above – which teaches us the importance of developments in exports and imports, including Mr. Trump’s jargoning. One of the lessons I learned a long-time ago, while attending Georgetown University in Washington D.C., is to thoroughly analyze economic facts, before taking a coherent decision.

I am sorry for not being able to portray a more promising outlook. Nevertheless, I wish us all the following:

May the coming year 2026 bring us all health, success and prosperity!