EMR December 2025

Dear Reader

REVIEW

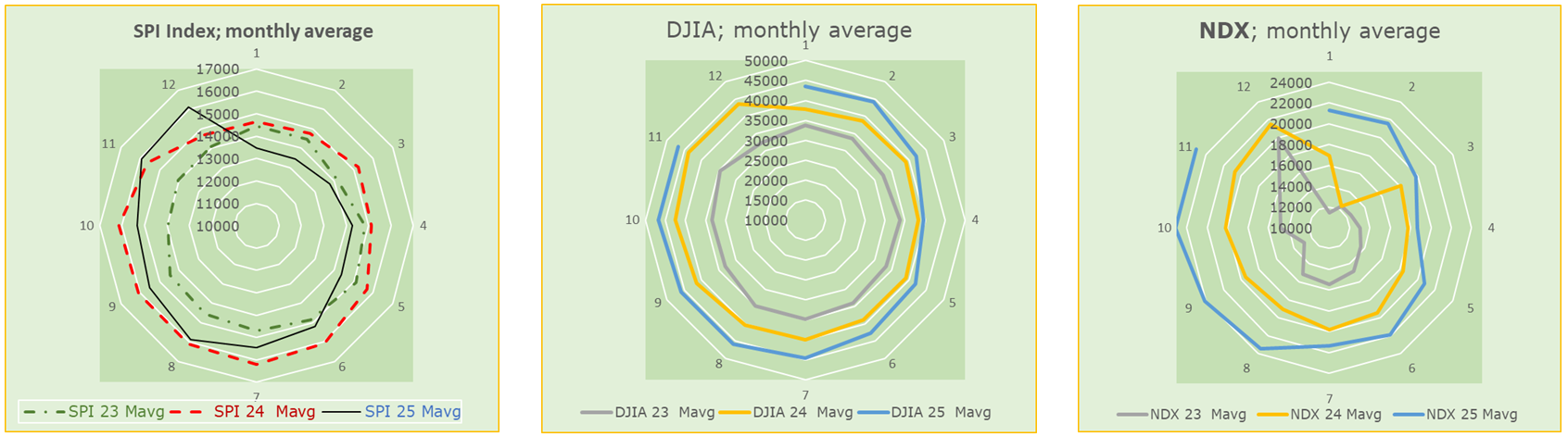

By examining the graph of the monthly averages of the SPI, DJIA, and NDX indices over the last three years, we find important indications for the immediate future. One factor regards the yearly differential developments, rather congruent between the SPI and the DJIA, while the NDX index developments point to specific determinants, both concerning 2023 as well as for 2024. Let´s recall that the NDX, on its part, comprises the 100 Nasdaq-listed nonfinancial companies with the highest market capitalization.

The following illustrations show the de-facto developments of monthly averages of the three shown indexes for 2023, 2024 as well as 2025.

What do the charts show? Well, it is rather difficult to conclude that a significant correction is imminent, except for the NDX index. However, the performance of the SPI and the DJIA index over the last three years is very significant. The following can be deduced from our analysis:

- An initial conclusion indicates fairly consistent and stable growth for the SPI and DJIA. The NDX, on the other hand, shows fairly strong reactions. In this context, we could argue that the probability of an imminent correction can be assumed for the NDX index, but not for the other two indices. From a contextual point of view, we emphasize that the indication highlights continuous technological developments. On the other hand, the charts for the SPI and DJIA stock indices do not indicate significant differences, signaling a fairly stable environment. However, it should be noted that the differences in monthly averages are quite small compared to the unreported end-of-month data.

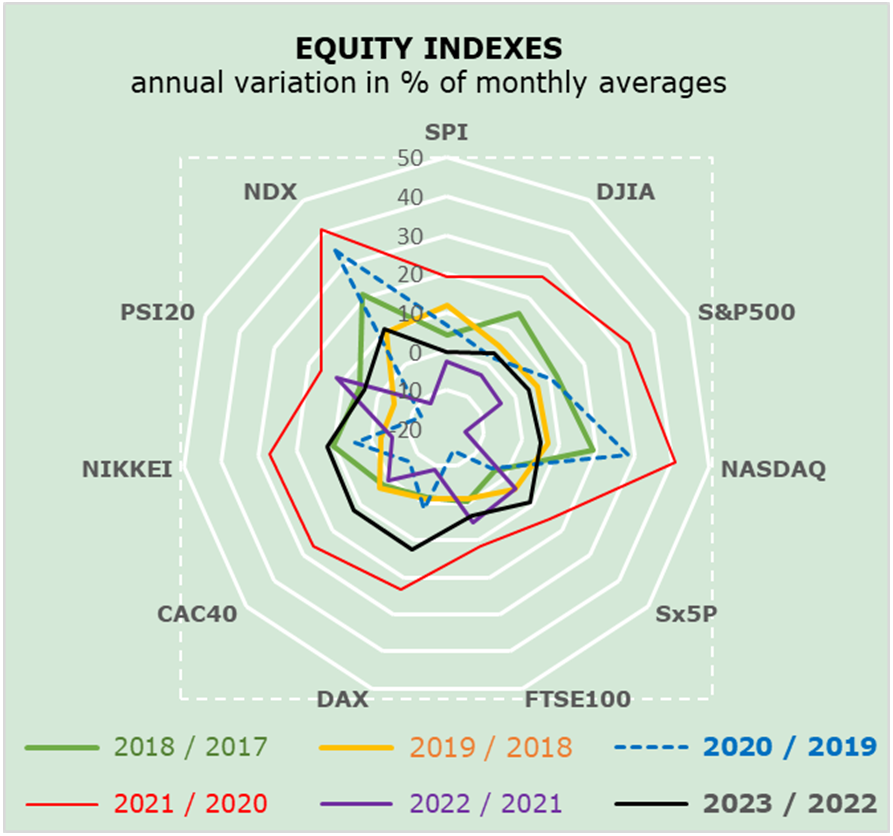

- Readers may argue that an analysis based on only three stock indices and only over three years is insufficient. For this reason, let us present the annual percentage change in the respective monthly averages of a number of stock indices, as shown in the following chart, stressing significant differences, as compared to the developments over the last three years.

The annual fluctuations between 2017 and 2022, compared to those of the last three years (see graphs above for SPI, DJIA, and NDX), are truly remarkable in terms of both their magnitude and from index to index, as can be seen from the graphs. A first specific argument, which is implicit but not apparent from the graph, concerns the fluctuations of the respective currencies (not shown in the graph). Another argument concerns the “technological” content of each index. It should be remembered that technology has played a decisive role in recent years – and will continue to do so – not only for the stock markets, but above all because of its manifold effects on the economic activity of various countries. At this point, it is worth comparing, at least by way of example, the fluctuations of the DJIA with those of the S&P 500 and/or the Nasdaq, as well as from country to country.

CURRENT ENVIRONMENT

Contextual analysis urges investors to take into account “additional and decisive factors,” such as Russia’s absurd war against Ukraine and the conflict in Gaza, which we believe could continue to be highly deterministic. Expectations remain conditioned by geopolitical instability, while technological innovation and central bank measures aim to fuel certainty. As a result, we believe that the economic outlook is far from rosy. Crude oil producers continue to play a rather dangerous role. Their goal is to keep energy prices as high as possible, for as long as possible, essentially to finance absurd and devastating wars.

In addition to the fact that consumption is the engine of economic activity and has therefore been and continues to be the driver of prosperity, we also expect various stimuli from international trade in essential goods and services. Nevertheless, it will be difficult to contain price increases. Consequently, the actions and responses of monetary authorities should not focus excessively on fighting inflation, but rather on stimulating domestic economic activity, which requires a shift from foreign investment to domestic renewal. It should be noted that other components of GDP do not appear to have contributed significantly to economic activity, which is a striking sign of overall weakness.

To better explain the concept and for simplicity’s sake, we will limit our analysis to developments in the United States, assuming that the impact may be somewhat similar in other industrialized countries. US data since 1947 show that consumer spending remains the main contributor to GDP. However, the table below on US GDP and its main components reveals some rather surprising results. Over time, consumer spending has tended to be less pronounced, i.e., less of a driver. The gap has widened over time. The growth differential is clearly visible in the data (see table below), while all other components of GDP seem to make only a marginal contribution. Whether this assessment is “right” or “wrong” as a measure of their respective levels is the appropriate question at this stage. Isn’t that, right?

To analyze the data on US economic activity shown in the table below, let’s first define the items: GDP = Gross Domestic Product; C = Consumer spending; IFIX = Investment spending; X = Exports; M = Imports; and G = Government spending. The overall rates are summarized in the table below:

| 1947 $bn* | Shares | 2023 $bn* | Shares | Growth $bn | in % | |

| BDP | 2’210 | 100% | 23’300 | 100% | 21’090 | 954% |

| C | 1’550 | 70% | 16’050 | 69% | 14’500 | 935% |

| iFIX | 360 | 16% | 4’340 | 19% | 3’980 | 1106% |

| X | 140 | 6% | 2’605 | 11% | 2’465 | 1761% |

| M | 160 | 7% | 3’643 | 16% | 3’483 | 2177% |

| G | 420 | 19% | 3’940 | 17% | 3’520 | 838% |

A careful examination of the data, shown in the table above, speaks volumes. Although the data indicate that consumer spending is the main driver, the growth rates of the other components of GDP suggest that imports are also a key factor, followed by exports and investment. Consumer spending ranks only fourth, while public spending precedes all other major components of GDP. The table confirms our conclusion that the causes of the current turmoil lie not so much in interest rate trends as in international social and moral turmoil (e.g. Russia’s war in Ukraine)!

EXPECTATIONS

The interpretation of the economic and political whereabouts remains controversial and difficult to define as a plausible and credible scenario. Volatility affects both the short and medium term. Monetary authorities and most analysts are primarily interested in restoring price stability, for example by means of higher interest rates. In this context, we continue to favor quality stocks, particularly in the technology sector. The level of long-term interest rates is favorable for quality bonds, at least in the medium term, which promise attractive yields and capital appreciation opportunities for the first time in a long time. Overall, we remain strongly focused on our domestic market for both equities and currencies.

Never before in human history has a pandemic forced governments around the world to shut down their economies so abruptly and almost simultaneously, only to revive them with massive stimulus packages. The outcome remains uncertain, pointing in some ways to a return of inflation, a contraction in the labor market, higher bond yield expectations, and persistently high public debt, all of which continue to fuel volatility.

At this time, we take the opportunity to wish you all a: MERRY CHRISTMAS & A HAPPY NEW YEAR 2026.

Comments are welcome.