EMR November 2025

Dear Reader

In this EMR, we would like to emphasize that the economic and investment environment has never been as complex and contradictory as it has been in recent years, and particularly in 2025. In our view, the current economic reality is unprecedented, while a new “ideological worldview” is shaping global politics and economics through self-appointed “dictators.” These developments are a cause for great concern, especially among quantitative economists. This is not primarily a question of economic reality, but rather a political issue.

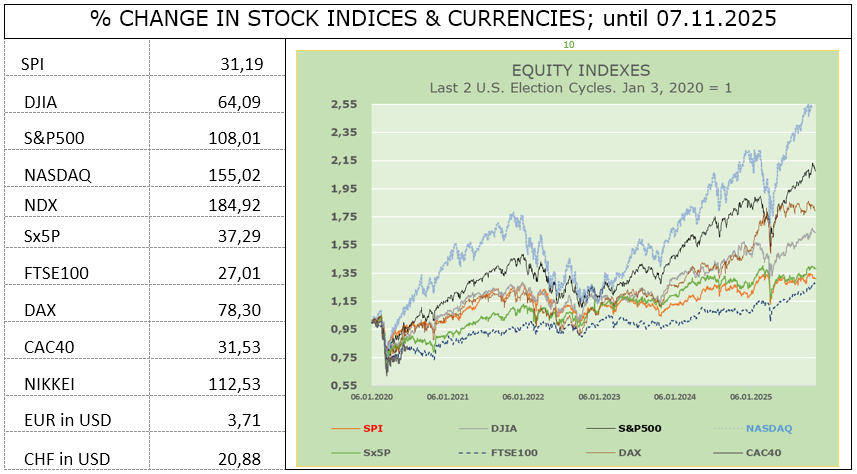

In other words, we are currently facing a welfare dictatorship that has nothing to do with an interpretation based on the examination of concrete facts. The trend in stock market indices is truly revealing, as the following chart implicitly shows.

The stock index chart, in their respective currencies, shows two distinct growth paths, linked by a significant correction phase. The first growth path covers the period from early 2020 to early 2023, while the second covers the period from early 2023 onwards. Growth rates are similar, but deviations are significantly more pronounced in the second period. Are there reasons for this disparity? The outperformance of technology indices is indeed significant. It is surprising that the growth patterns of the indices shown are somewhat coordinated, de-spite significant differences between markets. At this crossroads, we ask our-selves: What could be the reasons for the differences highlighted in the chart above? At least in the case of US indices, this cannot be attributed to negative expectations about economic activity, but rather to the effects of potential technological growth.

In 2022, the main deterministic factors were fears of an impending economic slowdown, high and widespread inflation, and the unpredictable impact of the war in Ukraine, which disrupted trade and drove up energy and food prices.

The political and social actions and reactions of the US president are also sig-nificant and destabilizing factors for the stock and currency markets. It is wor-rying that the focus is mainly on trade that primarily benefits the US. The re-percussions on Europe and the rest of the world are given little consideration, both in terms of economic activity and the security of local infrastructure. President Trump’s intention is primarily to benefit the US economy, regardless of the impact on trading partners. From an investment perspective, this policy mainly affects foreign trade trends, while commentators remain focused on interest rate regulation to combat inflation.

CRITICAL FACTORS FOR THE OUTLOOK

From the complex political situation and Trump’s nationalistic intentions, as can be implicitly inferred from his mercantilist focus, we draw the following conclusions:

Sectoral growth prospects:

The prevailing opinion seems to support the hypothesis that the most sig-nificant deviations in forecasts are due to the effects of growth in foreign trade and private consumption. This assessment is mainly due to the tax increases introduced by the Trump administration. In our view, there is no doubt that the sometimes absurd tax increases will contribute to nega-tive growth forecasts and price increases, regardless of the measures taken by central banks and, in particular, the decline in consumption by the general public.

Inflation expectations and interest rate cuts:

Not a day goes by without negative comments about inflation or inflation expectations. The fact is that the White House has repeatedly urged the Federal Reserve to lower interest rates, and will likely continue to do so, in order to stimulate economic growth and keep inflation under control. With all due respect, we disagree with these specific requests from the White House, as well as with the widespread and constantly reiterated “opinion of the majority of the public.”

We believe that the policy measures taken by the current US administra-tion cannot be determined solely by interest rate cuts. We are of the opinion that the tax burden cannot be resolved primarily through lower interest rates, given that the reduction in import prices at this time has little to do with the Fed’s measures. Foreign producers will seek to diver-sify their exports from the US to other countries, while at the same time seeking to reduce imports from the US.

Risk of Recession:

There is no doubt that the risk of recession is currently high and rising. The impact is not primarily on international trade, but on consumer spending. The political repercussions will be and remain the main source of great concern.

GROWTH PROSPECTS

According to our analysis, economic growth prospects have once again lost some of their recent momentum. We believe that this loss of momentum is mainly due to contradictory policies, which indicate a growing political trend toward an “increasingly closed market environment,” representing a dangerous shift toward isolationism. In such a political environment, it is unlikely that the policies implemented will produce the necessary and desired economic benefits, either for the United States or for its foreign counterparts. The question we are unable to answer at this time is when the US administration will initiate a reversal toward a more democratic environment. The current wave of “American nationalism” is not producing the expected economic benefits, either for the US fiscal authorities or for the foreign nations for which it was intended.

In our view, it seems rather obvious that, at this point in time, interest rate cuts may not be the optimal stimulus for economic growth, as the feared negative effects mainly concern consumer spending and international trade. A reduction in “valuable and necessary” imports of goods and services, achieved through tax increases by the importing country, does not necessarily encourage consumers to spend more, while price increases risk reducing the supply of essential foreign goods taxed by the importing country: the United States.

Furthermore, it seems rather obvious that, at this point in time, interest rate cuts will not stimulate economic growth in the country applying them, when the negative effects mainly affect consumer spending and international trade.

PERSONAL ASSESSMENT

The real question is what impact the scenario described above could have on asset allocation. Below are our assumptions and conclusions:

- It can be assumed that economic and financial uncertainty will persist for some time to come.

- The repatriation of capital investments from abroad should reduce the uni-verse of international investments.

- At present, we believe that economic and financial uncertainty is likely to endure for some time, unless the US president changes his mercantilist stance.

- We still wonder why public opinion continues to focus on interest rate adjustments to curb inflation and promote economic growth.

- Considering the potential impact of President Trump’s fiscal policy, we conclude that it will force leading companies to evaluate and reconsider the consequences of transferring various products from abroad to their home countries, bearing in mind that this could lead to higher costs, which will further push companies to automate processes in order to reduce costs.

- Contrary to our recent expectations, we are currently focusing on our do-mestic market, Switzerland. Step by step, we will also make consistent ad-justments in favor of European markets and significantly underweight the US market.

OUTLOOK

At this point, we believe that the decisive factor for current forecasts is the inflationary impact of Trump’s fiscal mania. We therefore do not share the view of the vast majority of analysts that monetary policy measures are and should be the most promising path to economic growth. Given the dramatic inflationary impact of Trump’s fiscal policy, we do not see how monetary poli-cy measures by the Fed or any other central bank can or should be the main determining factors.

Our current assumptions are based on the following premises: contrary to our recent expectations, we are currently focusing on our domestic market: Swit-zerland. Step by step, we will also make consistent adjustments in favor of European markets and significantly underweight the US market.

- Our currency forecasts favor the CHF, EUR, and GBP, less so the JPY, and even less so the USD. We are concerned about the continued “devaluation” of the USD in line with Trump’s absurd fiscal policy and the US government’s “anti-Fed” stance. At this point, we wonder whether it is appropriate to hedge equity exposures against their respective USD currencies.

- We have no doubt that international investors could avoid the US market in response to the US president’s absurd fiscal policy and instead favor European markets and, to a lesser extent, the Japanese market. At this point, we won-der whether it is appropriate to hedge equity exposures against their respec-tive currencies in USD.

Dear reader, we would appreciate your informed opinions.