EMR September 2025

Dear Reader,

The current economic environment is generally defined or considered to be rather unique, despite there being a long history of change. Being interested in the relevance of developments, both current and long-term, we are aware of factors that are not adequately addressed in press reports and recent studies. We like to remember that price trends, as demonstrated by long-term data available in the United States, tell a story of continuous change, sometimes minor, sometimes dramatic and difficult to assess. Therefore, we should bear in mind that inflation is a persistent problem, one that we may have to deal with not only in the immediate future.

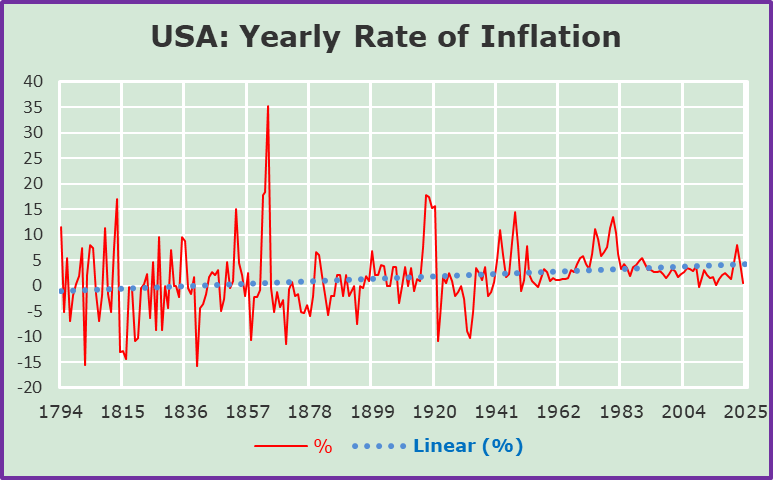

What can be inferred from the US CPI inflation chart, considering that the average inflation rate for the period from 1872 to the present amounts to 2.37%, with a maximum of 17.84% and a minimum of -10.94%? Let us emphasize that the overall average trend—dotted line—has been slightly rising, while the recent trend (since 2000) indicates a significant slowdown.

Furthermore, it should be noted that the rate of change has been significantly higher in the period prior to 1870 than in the period thereafter. The graph also shows that the overall deviation for the period between 1980 and the early 1960s has been fairly modest.

The inflationary trend since the late 1970s has been surprisingly “moderate.” Without going into details about inflation trends, since the late 1970s we note a downward trend compared to the previous period. The reasons for this are not easily quantifiable, aren’t they?

Without examininsg the develomenats of inflation trends in other countries and currencies, to answer the above posed question, let us summarize key events that, so far, have had – and still might have – a decisive impact. Although the following list imight not be exhaustive, we believe it to be quite significant for the current forecasting outlook.

- On January 20, 2025, Mr. Trump was inaugurated as president of the United States for a second non-consecutive term.

- On April 9, 2025, he announced the suspension of customs duties for a period of 90 days, with the exception of China.

- On April 17, 2025, he attacked Fed Chairman Powell with the statement, “When he leaves, it will be too late.”

- On May 8, 2025, he signed a trade agreement between the United States and the United Kingdom.

- On May 11, 2025, China and the United States signed a 90-day suspension

- On May 16, 2025, Moody’s downgraded the United States’ rating from “AAA” to “Aa1.”

- On May 23, 2025 Mr. Trump announced 50% duties to Europe.

- On June 21, 2025 the U.S. bombs sites of Iran for uranium enrichment.

- On July 8, 2025 Mr. Trump extended the deadline for new agreements to August 1, 2025 (e.g. tariffs on copper of 50% and also 200% tariffs on pharmaceuticals).

- On August 7, 2025, he did not “chair” the meeting with the high-level Swiss delegation at the White House.

- Meeting in Alaska, August 15, 2025, between US and Russian presidents, Donald Trump and Vladimir Putin, was billed as a promising step towards peace in Ukraine. According to press information no ceasefire and an invitation to Moscow, were announced! The meeting yielded more questions than answers.

Now let us ask ourselves what can we deduce from the long-term U.S. inflation chart, taking into account the above listed developments regarding the economic outlook and financial market trends?

BETWEEN PAST AND FUTURE

The current political and economic environment is quite complex, making it difficult to assess with a high degree of certainty and precision. Even a fairly simple analysis of price changes reveals that, on many occasions, we have faced economic and social contexts that were difficult to predict. Price inflation, as we all know, has been a persistent and challenging problem, one that we may continue to face. not only in the near future, but also in the longer term. In the economic literature, we have found specific phases, that began in a very similar way to what is happening now. The phases that come to mind indicate similar starting points and, at times, divergent paths, known as stages. A “simple” review of price changes shows, as implicitly illustrated in the chart above, that we have almost always faced considerable difficulties in forecasting. We therefore assume that price inflation could persist and, with the active support of President Trump, could be a serious forecasting obstacle not only over the short term but also in the longer term. In the economic literature, we find certain phases that begin very similarly while leading to different outcomes. At this point, we would like to point to four main phases, illustrating current forecasting difficulties:

- A first phase might be defined as a phase of “quiet beginnings, and also of slow progress”.

- A second, slightly different phase, is characterized by the “overcoming” of previous price limits. The contextual and deterministic factors were wars and/or changes in the system of government, as well as drastic increases in the prices of raw materials such as crude oil.

- A third phase concerns the hypothesis that “price changes are due to inflation expectations,” i.e., changes in long-term trends. A particular limitation concerns the assumption that investors believe that the trend may require an expansion or contraction of the money supply. At this stage, the rate of change in the money supply is considered the relevant indicator which, in due course, would confirm to some extent the assumptions of an increase/decrease in inflation. In this context, economists refer to financial market instability.

- Finally, the fourth wave “peaks and breaks down with shattering force”, with dramatic consequences, including recessions and political change

It should be borne in mind that each phase had significant social consequences and that each price trend exhibited common wave structures of varying duration and scope.

Implicitly “visible” in the above shown chart are also the respective effects on the medium-term inflation outlook.

Currently, as in the past, there will be social and economic disparities also on a country-by-country basis. Even today forecasters should seriously consider the implicit impacts on the asset allocation exercise.

The recent meeting between US and Russian presidents, Donald Trump and Vladimir Putin, in Alaska was billed as a vital step towards peace in Ukraine. As we see it, without a ceasefire and an invitation to Moscow, the meeting has yielded more questions than answers.

OUTLOOK DETERMINANTS

At this crossroads, we believe that the determining factor in the current forecasting exercise concerns the inflationary repercussions of Trump’s fiscal mania. Therefore, we disagree with the vast majority of analysts who believe that monetary measures are the most promising course of action for economic growth. We do not see how the monetary actions of the Fed, or any other central bank, should be the primary deterministic actions, given the dramatic inflationary impact of Trump’s fiscal stance. The meeting between the US and the Russian presidents, D. Trump and V. Putin, in Alaska, can be billed as a vital step towards peace in Ukraine. With no ceasefire and an invitation to Moscow, the meeting has yielded more questions than answers.

EXPECTATIONS

Our specific assumptions are based on the following setting:

- As in previous EMRs, we persevere in favoring primarily investments in our home market: Switzerland followed with coherent judgement by investments in Europe and a significant underexposure to the USA.

- Our currency expectations continue to favor the CHF and EUR, less so the JPY, and even less so the USD. We are concerned about the persistent devaluation of the USD in line with Trump’s absurd fiscal policy and the US administration’s “anti-FED” stance.

- Somehow, we disagree with the assumption that interest rate cuts in the USA ought to be viewed as the primary motor of economic activity. The center of economic policy is set on “increases in import-taxation” boosting fears of inflation.

- In our opinion, investors will avoid the US market, favoring the European markets and, to a lesser extent, the Japanese market, as an appropriate response to the absurd policy of the US president.

- At this point, we wonder whether it would be appropriate to start hedging equity exposures against their respective currencies in USD.

Dear reader, we would really appreciate to know your coherent assessment?

* Mark Twain