EMR April 2023

Dear Reader,

On March 10, 2023, the U.S. “Silicon Valley Bank” (SVP) faced significant capital withdrawals from its customers, marking the beginning of a new financial crisis. It represents the beginning of the withdrawal of funds from a relatively small bank. Markets around the world panicked. The rather unexpected development coincided with massive interest rate hikes by various central banks. A second U.S. bank – First Republic Bank (FRC) – followed suit. Credit Suisse, Switzerland’s second largest bank, came under fire and was then taken over by UBS. Huge amounts of emergency money – mainly from central banks and government agencies, as well as a few powerful players – stemmed the emergency bailout. The contextual question relates to the reaction of the stock markets?

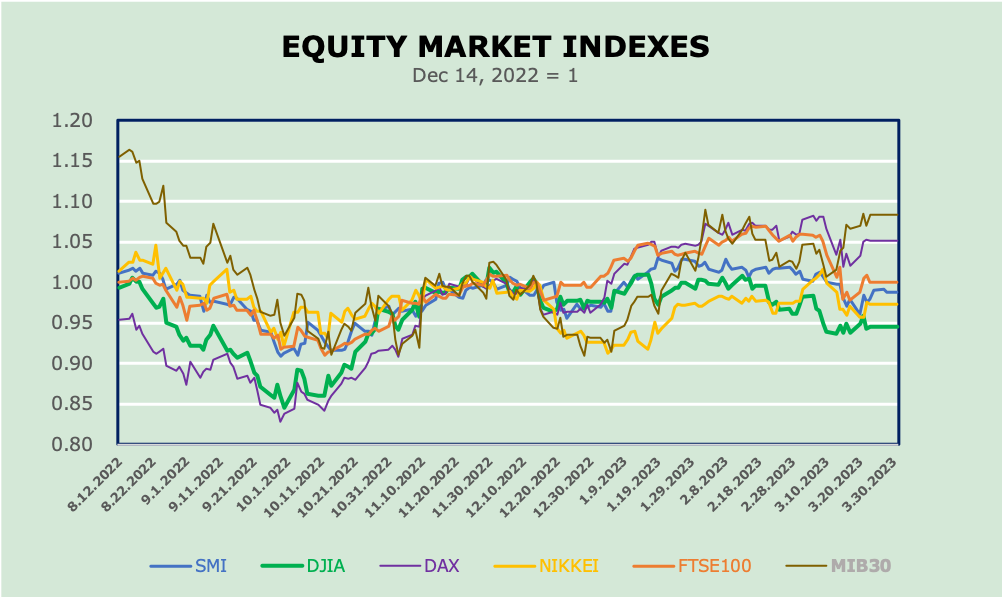

We deem it useful to examine the actions and reactions of a selected group of stock indices. In the chart, the reader finds information about the trend and the respective highs and lows of each shown stock index. The series are indexed to December 24, 2022 equal to 1.

We have no doubt that volatility will persist given the uncertainties surrounding other potential bank failures and the hoped-for outcome of the UBS merger and any reorganization of the giant Swiss bank.

FACTORS OF INFLUENCE?

A basic prerequisite for an effective solution to the complicated environment is a coordinated effort in the financial and foreign exchange markets. Such an effort is necessary to calm the highly speculative environment and avoid a full-scale recession. The much-discussed arguments depend on the particular viewpoint of the public or private entities involved. Will the economic outlook be primarily demand-driven or supply-driven? If one compares the outlook for the U.S. with that for Europe, one encounters highly contradictory perceptions. There is no doubt that the upturn in the USA will be demand-driven rather than supply-driven. Critics are vociferously calling for the “repatriation” of production, for example, to reduce dependence on China and thus boost domestic incomes and consequently consumer spending. The goal is nothing less than regaining independence from autocratic, anti-democratic production units. In the short term, this would mean a possible increase in inflation. In a way, such a scenario would contradict the Fed’s anti-inflation policy. In Europe, the recovery remains supply-driven due to the heavy dependence on crude oil and gas imports from Russia.

At this crossroads, we should not forget that the U.S. government is in charge, while Europe is dependent from a despotic personality. This constellation merely implies that the fight against inflation through higher interest rates in the U.S.A. could not easily apply to Europe as well.

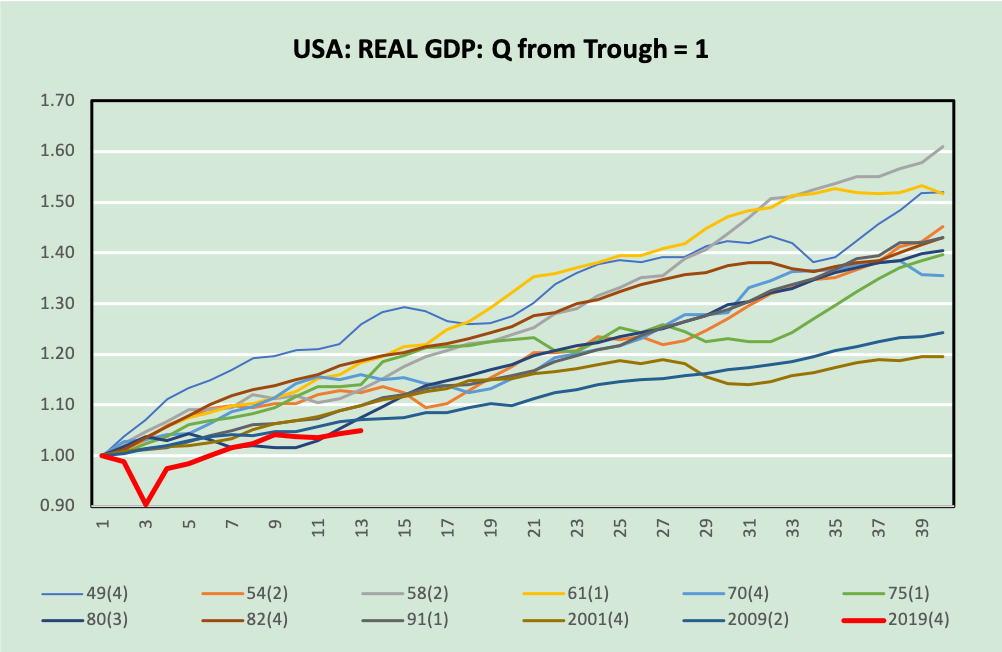

The analysis of the potential development of economic activity as it results from the available real quarterly gross domestic product (GDP) data for the U.S. is very revealing in some respects. So far in the current cycle – starting in Q4 2019 – the absolute bottom (for now) was reached in Q2 2020! Since then, GDP has recovered somewhat, but based on available data, this is the weakest absolute recovery since 1940. We wonder why this whereabouts have not yet worried analysts. Why was no attention paid to it either before the banking crisis or afterwards?

WHERE STOOD THE SUPERVISORS?

The short- and medium-term outlook is always difficult to quantify. Facts and actions by governments, financial authorities and the banking institutions themselves remain difficult to assess. There was, and to some extent still is, a great ambivalence between knowledge of what is happening and consistent interpretations.

It is interesting, revealing and significant that the focus was not so much on the big players, but on the Swiss financial system, which led to the merger of “CS” with UBS. A development that not only led to the demise of Credit Suisse, but above all brought into focus the poor functioning of international and national supervision. Such an approach was in clear contradiction to what had always been required for any Swiss or foreigner operating in Switzerland. One concrete consequence was a massive loss of confidence at the global level, which was primarily due to risk management that can be described as illegal and thus punishable. At this point in time, we do not want to and cannot place the blame primarily or exclusively on Swiss supervision. The disaster has much more to do with global supervision than with the supervision of the country to which Credit Suisse belonged.

CONSEQUENCES

The failure of Credit Suisse is an event that will be hard to forget. It shows us, among other things, that the supervisory approach can no longer be required primarily of local supervisors when business is conducted on a global scale. We wonder what the specific supervisory arrangements will or should be (not only) for Maxi – UBS. What has always been known, but for a long time deliberately kept in the background, is now a clear and glaring reality, namely that the financial market is no longer a national market, but a global market for which the same rules of protection should apply everywhere.

There is no doubt that the current financial market turmoil will have an impact on employment, consumer and investment spending, international trade and currencies. It is clear that international coherence must be restored at the expense of the gains of a few market participants.

DETERMINANTS OF THE PROSPECTS?

In our view, country by country demand for domestic goods and services should restrain international trade. We firmly believe that in such an environment, price increases, should be restrained. This expectation of ours, together with the Russian war against Ukraine, assumes a trend toward domestic production and consumption. In the short to medium term, international trade does no longer appear to be in the driver’s seat. Such an environment is a harbinger of increased volatility on both the quantity and price fronts, including currencies.

In particular, we expect a few quarters of slowing economic activity. However, a recession cannot and should not be ruled out. At the moment there are several deterministic elements that are rather difficult to assess. The first remains the continuing invasion and war against Ukraine, followed by the trend of rising interest rates by monetary authorities to combat rising inflation. Another difficulty is the trend of “repatriation” of productive capacities, with the related repercussions on the currency front.

IMPLICATIONS FOR INVESTORS

The recent constellation indicates ambivalent expectations regarding economic growth and central bank interest rate operations. Originally, there should have been a growing trend away from import dependence and a significant increase in domestic production, not only of technological goods. With this approach, a significant increase in demand for locally produced goods and services could have been expected. The shift to increased domestic production would have required a slightly different monetary policy than that recently adopted. More domestic investment would have led to higher employment and wages, with a somewhat different result. But as we all know; the outcome is quite different and complicated.

In the short term we continue to view equities, despite increasing volatility, as promising compared to fixed income securities. A switch may be on the cards for the period, pointing to rising interest rates. On the currency front, we continue to prefer our local currency over the USD and EUR. The most promising investment advice that can be given is to focus on HIGH QUALITY.

Comments are welcome.