EMR January 2023

Dear Reader

ENVIRONMENT 2023

At the beginning of the new year, we may ask ourselves which of the following statements may be considered correct and thus a valid indicator of the most likely future developments:

- Is significant inflation acceleration, plus 4% or more, a negative for the equity markets?

- Is significant decrease, minus 2% or more, a positive for the equity markets?

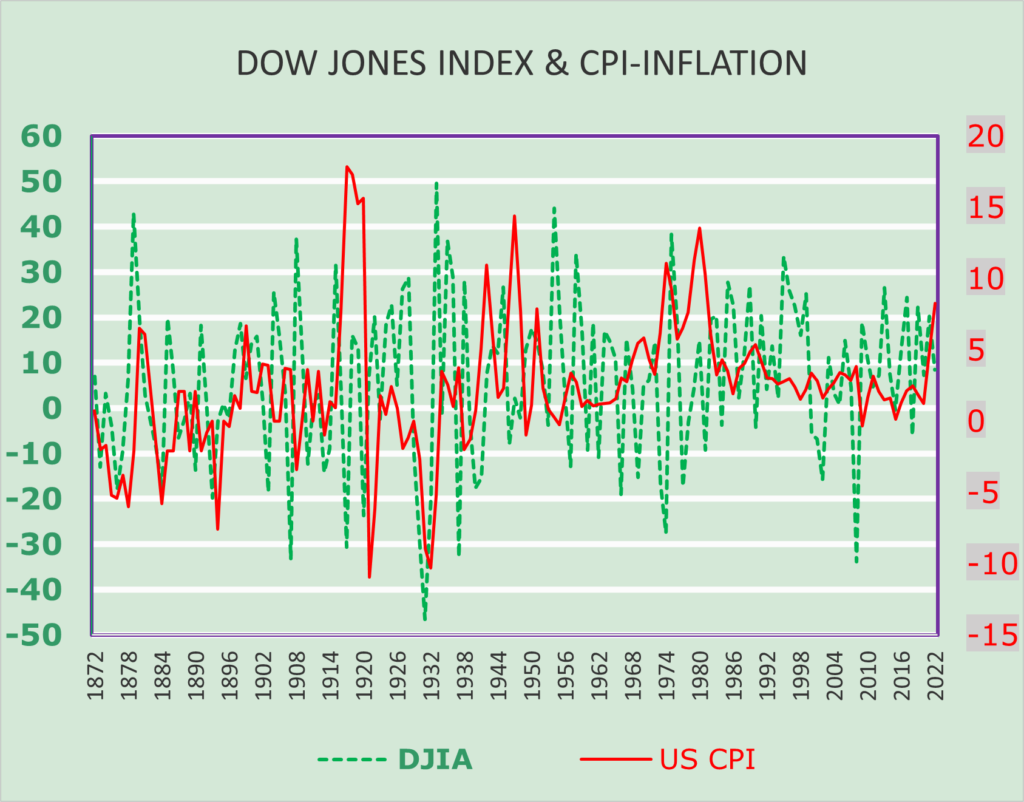

Bevor answering the two above posed questions let us portray the historic developments of the leading economy, the USA, as shown in the chart.

What does the historic representation of the yearly average changes of the DJIA and the yearly rate of change of the US Consumer Price Index tell us? Our interpretation of the graph shows several interesting things:

- The analysis of the annual rate of change indicates that changes in the DJIA are much more volatile than for the consumer price index.

- Both the development of the inflation rate and that of the DJIA, before 1945 and since 1945, differ considerably from those of the preceding period. This makes predicting future developments – for both indicators – somewhat more difficult than generally assumed.

- The rather contained inflation rate swings since 1980 do not point to a significant growth in the equity index.

After a thorough analysis of the diagram, we come to the following conclusions:

First, we note that the actual annual changes in the inflation rate are less volatile than those in the DJIA index. This suggests, in our view, a deterministic distinction between the two categories under consideration. In other words, the respective trends are not primarily determined by the same factors for the DJIA and the CPI-Index.

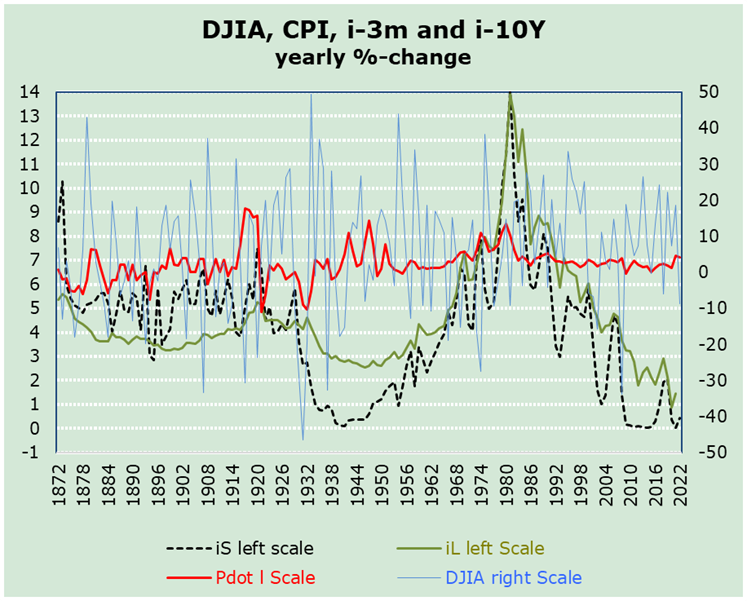

So far into the current cycle, inflation has not (yet) risen as in the late 70’s nor in the previous cycle. The real question at this time is which of the two series used here will be the deterministic factor: the DJIA or the CPI? Any suggestions?

OUTLOOK 2023

Recalling the various expectations and taking into account the available hard facts as compared to the known developments in 2022 as a starting point, we firmly believe that the outlook for 2023 remains characterized by known and also imponderable features. The challenging question to answer at this time concerns, first of all, the hoped-for end of the disastrous Russian invasion of the Ukraine. This “hoped-for return to normalcy” would undoubtedly lead to lower crude oil and gas prices and, as a result, would also lead to a reduction in fears of persistently high inflation and would consequently encourage the inflow of much-needed technological inputs. The result would be a significant pickup in economic activity, instead of the recessionary outcome currently feared.

For Central Banks, this would imply a deterministic reduction in recession fears and the abandonment of restrictive monetary policy. This, in turn, would promote an economic recovery that should boost stock markets and, to some extent, fixed-income investment as well. High inflation rates historically have been associated with financial losses, as they have also been in the recent past. History teaches us also, that patience is a promising attitude, especially when the causes of inflation are due mainly to factors that are not so much monetary as economic or even worse political.

FINDINGS FOR INVESTORS

Assuming that the Russian invasion of the Ukraine is unsuccessful, it can be assumed that Russian oil and gas supplies will slowly increase, which should tend to reduce the inflation rate. This makes it unlikely that domestic banks will continue to push interest rates up, as they have done recently. In other words, the appeal of fixed-income securities may be limited to the next few months of 2023. However, we believe that the appeal of fixed income is likely to be limited to the coming quarters, limiting the appeal of equities in the first quarters of 2023.

Our assessment depends largely on the size and length of the expected economic slowdown, which, in turn ought to bring inflation down. The necessary and sufficient condition for this to happen, is that inflation begins to fall in line with the decline in energy costs. In any case, special attention should be paid to currency fluctuations when diversifying internationally. Highly indebted companies should be avoided. As Swiss investors, we continue to prefer the local market, at least until the end of the cyclical interest rate increase will manifest itself. In any case, in the international diversification process, special attention should be paid to currency fluctuations. Highly indebted companies should be avoided. As Swiss investors, we continue to prefer the local market, at least as long as the end of the interest rate cycle is in sight.

We wish you all A HAPPY NEW YEAR

Comments are welcome.